Bajaj Housing Finance IPO Allotment Status: The upcoming Bajaj Housing Finance IPO is a massive event on the stock market, with most investors discussing the issue.

Table of Contents

From checking the IPO allotment status of KFintech, Linkintime, and many more, down to understanding the latest trends in Grey Market Premium, every investor is desperately trying to know the present status.

Check the latest process for checking your IPO allotment status, the latest GMP, and other related details for the Bajaj Housing Finance IPO here.

How to Check Bajaj Housing Finance IPO Allotment Status ?

The allotment of the IPOs is keenly awaited by investors. Here are two options, one by KFintech and another by Linkintime, to check the status of the allotments. Steps to Check Your IPO Status:

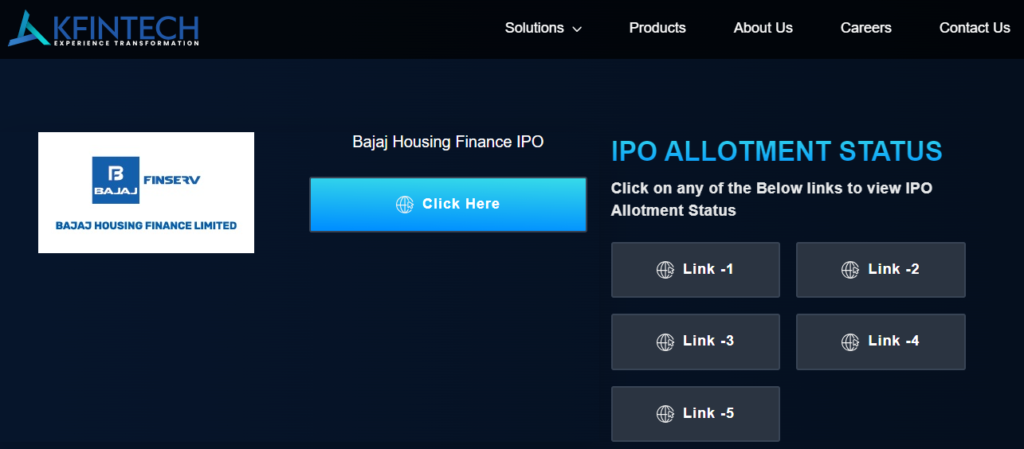

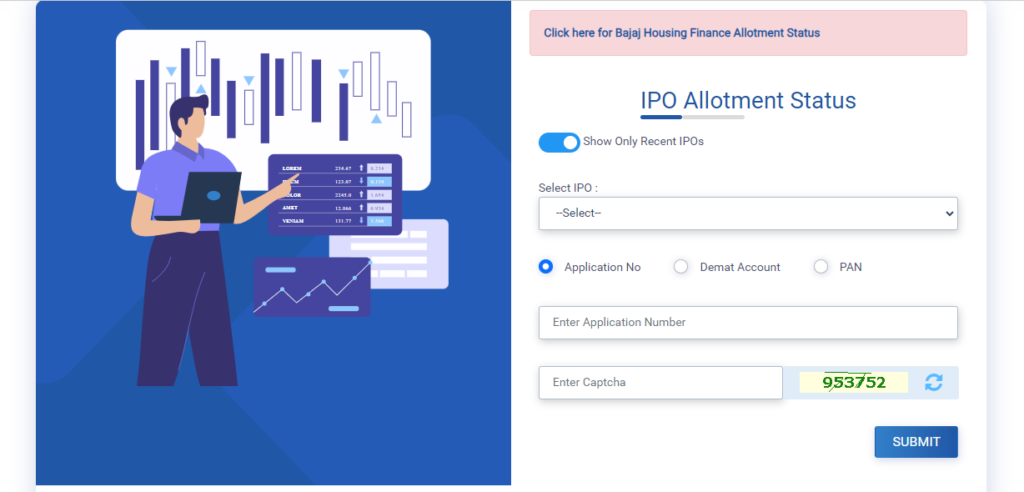

Steps on KFintech:

Visit the official website of KFinTech: direct link.

Choose “IPO Allotment Status” from the dropdown.

Enter your PAN No. or Application ID.

Click on ‘Submit’ to check your allotment status.

Steps on Linkintime

Please see Linkintime Online: (Direct Link).

Click on the “IPO Allotment” tab.

Enter Application details: Enter PAN or DP/Client ID.

You will see your status immediately.

Equally important is how to know your allotment status using the two stock exchanges, NSE and BSE. Investors using either can find their allotment information through a simplified step.

Bajaj Housing Finance IPO Grey Market Premium (GMP) in detail

GMP depicts the indirect performance of an IPO. The GMP levels have been very fluctuating for the Bajaj Housing Finance IPO, thus for the very same reason, it reflects investor sentiment in front of its listing.

Latest GMP Trends:

At the last available rates, the GMP was ₹X per share for the Bajaj Housing Finance IPO. This means the stock might list with or around this premium over the issue price, depending on market conditions.

Impact on Listing Day:

A higher GMP indicates that investors expect good listing gains. It further said investors must also focus on market volatility, sentimental aspect of the stock market, and company fundamentals before taking any decision.

The GMP movements across different exchanges including the BSE and NSE will indicate the expected listing price.

Offer Details for Bajaj Housing Finance IPO

It is of the essence for an investor to know the important dates accompanying an IPO. Below are the details of some important dates:

- IPO Opening Date: [September 9, 2024, to September 11, 2024]

- Expected Date of Completion: IPO, [September 9, 2024]

- Allotment final date: [September 9, 2024]

- Refund Request Date: [ Friday, September 13.]

- Listing Date: [September 16, 2024]

Listing on BSE and NSE: The IPO shares of Bajaj Housing Finance will be listed on both BSE and NSE. The date of listing should be closely watched by investors, as any trend set by it may spill over to near-term performance for the stock.

You can keep track of these dates to avoid missing any important step in the IPO process.

How to Check Bajaj Housing Finance IPO Allotment Status by PAN

If you have been allotted the IPO and would want to check the allotment status by PAN, then follow these steps:

Website: For details visit KFintech website or Linkintime. Subscribe to the Bajaj Housing Finance IPO now.

Put the PAN number.

This screen will display your status of allotment-the fact whether you have been allotted shares or not.

Why PAN-Based Checking is Important:

Fast and Secure Status Verification of Allotment on the basis of PAN. This would be much more friendly to the retail investor by making status checking minimally informative.

In the case you key in the PAN, it saves you remembering the application numbers and other specifics.

Bajaj Housing Finance IPO: Expected Listing Gains and Market Sentiments

It should be noted that market sentiment for the Bajaj Housing Finance IPO was good, and some analysts had predicted that the company would reign post-listing. At GMP, strong listing gains are indicated, but this might change due to various factors, and here are some to consider before taking the

Decision: Basics: Bajaj Housing Finance enjoys a strong wicket of long-term growth, backed by good track records in housing finance.

Market Conditions: Strong bull market conditions would escalate listing gains, while market correction might bring down the euphoria.

Peer Comparisons: Recently listed similar IPOs offer some clues about the likely success of the Bajaj Housing Finance IPO. Any investor should do his homework and know whether to operate on ‘hold’ or ‘sell-on-listing’ day.

This series of the grey market premium and market trend depicts a ray of hope for the investors in the Bajaj Housing Finance IPO.